Article

The investor’s guide to a 1031 exchange via a DST

Tips on how to execute a 1031 exchange

A Delaware Statutory Trust (DST) is a trust formed under the Delaware statutory trust law that allows passive, fractional ownership in real estate while qualifying as a “like-kind” real estate replacement property under Section 1031.

Section 1031 of the Internal Revenue Code allows taxpayers to defer paying tax on the gain from the sale of business or investment real estate by reinvesting the gross sales proceeds into similar real estate property(ies) with a fair market value equal to or greater than the fair market value of the sold property(ies) as part of a qualifying like-kind exchange.

How do I execute a Section 1031 exchange?

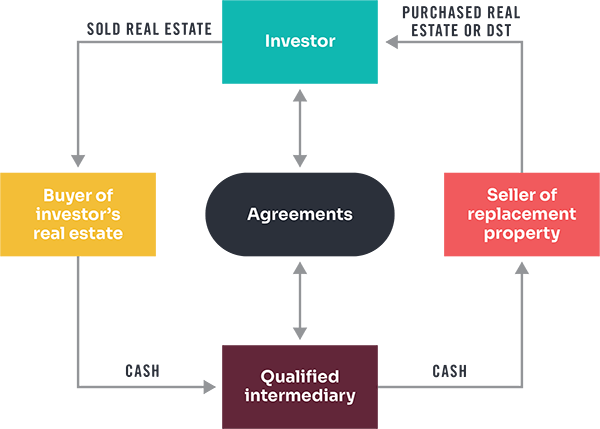

In addition to searching for replacement properties and DSTs ahead of closing on the sale of your real estate, advance planning is important because the majority of 1031 exchanges are not executed with the simultaneous sale and purchase of replacement property. To accomplish a deferred exchange, engaging a Qualified Intermediary (QI) before closing on your sale is required to ensure compliance. The role of a QI is to defer constructive receipt of sale proceeds until the replacement property is ready to close. From a tax perspective, the QI receives and transfers the sold property and subsequently acquires the replacement property and transfers it to you to complete the exchange, as shown in the diagram below.

What is boot?

Boot is the term used to describe a portion of the exchange transaction that is not “like-kind.” Boot does not invalidate the 1031 deferral, but it is taxable. Examples of boot include:

- The fair market value of personal property acquired as part of the purchase price of the replacement property (e.g., furniture or equipment).

- Purchasing replacement property less than the value of the property sold and receiving cash or debt relief.

- Reinvesting less than all of the net equity from the sale of the relinquished property and receiving cash back.

Boot is not uncommon, but the following steps will help minimize taxable boot:

- Purchase “like-kind” replacement property in an amount equal to or greater than the sold property.

- Reinvest all the net equity received from the sale of the original property.

Important – When using one or more DSTs as replacement property, the net equity needs to be reinvested in property with a value equal to or greater than the value of the sold property. However, the DSTs should be chosen, in part, to replicate the debt-to-equity ratio of the property they sold. For example:

| Relinquished property sale price | $10,000,000 | ||

| Debt at sale | $6,000,000 | 60% | |

| Net equity | $4,000,000 | 40% | |

| DST #1 | |||

| Property value | $100,000,000 | ||

| Property debt | $50,000,000 | 50% | |

| Net equity | $50,000,000 | 50% | |

| DST #2 | |||

| Property value | $80,000,000 | ||

| Property debt | $50,000,000 | 63% | |

| Net equity | $30,000,000 | 38% | |

| BLENDED INVESTMENT TO AVOID BOOT | |||

| DST equity | DST pro rata debt | Value of replacement property | |

| DST #1 | $1,000,000 | $1,000,000 | $2,000,000 |

| DST #2 | $3,000,000 | $5,000,000 | $8,000,000 |

| $4,000,000 | $6,000,000 | $10,000,000 | |

| Blended | 40% | 60% | |

Download our interactive 1031 Like-kind Exchange Estimator Tool to estimate the potential tax savings of using a like-kind exchange when selling and buying investment real estate.

How many properties can I identify?

The identification rules provide reasonable flexibility for investors to identify multiple replacement options to diversify their reinvestment and to hedge against the potential that one of the identified properties fails to close. Generally, investors may either identify:

- Three properties without regard to their fair market value; or

- Any number of properties so long as the aggregate fair market value does not exceed 200% of the fair market value of the relinquished property(ies).

Should an investor fail to meet either of the safe harbors above, the 1031 exchange benefit could still be obtained if the replacement property is acquired before the end of the identification period or if at least 95% of the fair market value of all properties identified are acquired before the end of the exchange period

How do I document identified properties?

Investors aiming to achieve a 1031 deferred exchange must report the identified properties to their Qualified Intermediary within 45-days from the date of sale. The notice must include a specific description of the replacement property that includes the legal description or street address, or in the case of a DST, a distinguishable name suffices.

For more information on this topic or to learn how Baker Tilly specialists can help, contact our team.

Delaware Statutory Trust

A powerful investment vehicle for real estate investors, private wealth, family offices and private equity.