Reducing import tariffs means more competitive positioning, higher revenue, and better margins for a US manufacturer in Brazil

Our client’s need

The client is a U.S.-based manufacturer of customized industrial assembly line equipment which sells its products in more than 50 countries worldwide. As a current international tax consulting client, they collaborated with Baker Tilly’s global market development specialists on strategies to reduce duties and tariffs when exporting their systems from the industrial Midwest to Brazil.

Baker Tilly solution

Import duties and tariffs, when not properly addressed, can significantly reduce a company’s ability to compete in Latin America, particularly in restrictive import markets such as Brazil, where tariffs can reach up to 100 percent of a product’s value. Baker Tilly’s experienced import/export professionals leveraged the firm’s proprietary, customized process capable of significantly reducing import tariffs for clients.

Baker Tilly proposed the use of its proprietary methodology and related export/import strategy to reduce import duties, tariffs, local taxation, and the overall burden on key products into Brazil. This and a subsequent execution plan focused on improving competitiveness in Brazil and adjacent markets from which the client’s industrial equipment can be shipped and sold at lower duty profiles.

Results

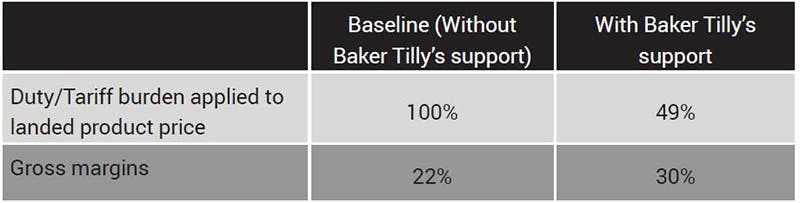

Bottom line: By reducing tariffs through Baker Tilly’s methodology, the client can expect to achieve higher profits and a lower overall price for its Brazilian customers.

Improvement in import duties and tariffs:

The ongoing value in adopting Baker Tilly’s export/import strategy includes:

- Unlocked Brazilian/Latin American market for perpetual harvesting and capitalization;

- Improved operational efficiency and competitiveness in key markets; and

- Progress towards increased sales, diversified revenues, expanded global footprint, and market resilience for the near- and long-term.

For more information on this topic, or to learn how Baker Tilly tax specialists can help, contact our team.